EDHEC Risk's 10th European ETF & Smart Beta Survey

Tuesday 13 June 2017

Press Release

Publication of the EDHEC-Risk’s 10th European ETF and Smart Beta Survey

The EDHEC-Risk Institute has announced the results of the 10th EDHEC European ETF and Smart Beta Survey, a comprehensive survey of 211 European ETF and Smart Beta investors, conducted as part of the Amundi research chair at EDHEC-Risk Institute on “ETF, Indexing and Smart Beta Investment Strategies”.

Key findings to the latest survey:

A growing use of ETFs

- ETFs make up an increasing proportion of portfolio holdings across Equity and Fixed Income

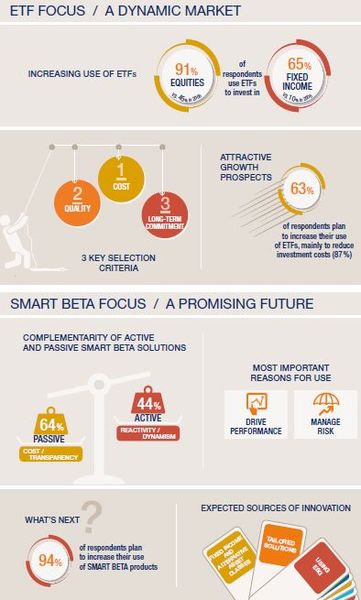

- In 2006, 45% of respondents used ETFs to invest in Equities compared to 91% in 2016

- In 2006, 10% of respondents used ETFs to invest in Fixed Income compared to 65% in 2016

- About two thirds of respondents (67%) use ETF to invest in Smart Beta in 2016, a considerable increase compared to 49% in 2014

Quantitative & Qualitative criteria guide ETF investors in their allocation choices

- When choosing an ETF provider, investors look carefully at Cost, Quality and Long Term commitment

- 63% of respondents plan to increase adoption of ETFs with main goal to lower costs

- Investors expect ETFs to be further developed in the Equity (asset class) and in the Smart Beta field to get exposure to mono and multi factor indices

How investors choose and use Smart Beta solutions

- Investors use Smart Beta strategies with 2 main objectives: improve performance and manage risks

- Liquidity, index construction methodology and transaction costs are decisive when assessing SB solutions

- 64 % of respondents invest in Smart beta passive solutions for Cost and Transparency reasons

- 44% of respondents invest in Smart Beta active solutions to benefit from the Reactivity and Dynamism they allow

Significant Smart Beta development perspectives

- 94% of respondents want to increase the use of Smart Beta strategies over the next 3 years

- Investors wish further development in the Smart Beta Fixed Income field and in Alternative and customized solutions