ETF Trend Report - 2nd quarter 2017

Wednesday 05 July 2017

Expertise, Video

Flows towards European ETFs have extended their first quarter positive trend and now exceed the 50bn€ mark over the year to date period. Equities are still most favored by investors as they represent nearly 65% of these flows.

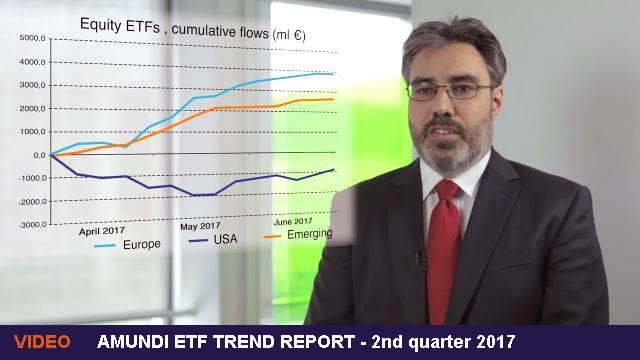

European equities were the most attractive, especially after the outcome of the French presidential election, which cleared doubts about the future of the European Union. Then come the emerging equities which continued on the rebound that started in 2016 by attracting more than 2 bn€.

US equities, on the other hand, underwent a reversal of trend with outflows of more than 1 bn€ in the second quarter, as investors have arbitrated from North America to the Eurozone.

Flows allocated to Smart Beta products amounted to 2.2 bn €, with value and mid cap factors remaining the most popular, in line with the trend observed in the first quarter.

In the fixed income universe, the situation is essentially the same as on the equity side, with a continuation of the major trends observed in the first quarter. It is therefore emerging country debt that still receives the largest share of flows, with nearly 7 bn€ in the first half of the year.

As far as credit is concerned, floating rates are still favored by investors who have allocated nearly 3 bn€ to this asset class since the beginning of the year. Next comes American corporate debt, which continues to offer a much higher return than its European equivalent and has attracted nearly 2 bn€.

In a continuing low interest rate environment, the search for yield remains the main driver of fixed income allocation.

The outflows were concentrated on US inflation-linked bonds with more than 1 bn€, as expectations of price increase in the United States that followed the election of Donald Trump have been largely revised downward in recent months.

Finally, a renewed interest in commodities can be noted. The asset class has been allocated 2.4 bn€ over the first half of the year, already as much as for the whole of 2016.